Hello lovely reader – and thanks for clicking through to Mobile Money Revolution.

The fact that you’re here proves that you are highly intelligent and attractive, and also that you’re searching for information on the mobile money space.

And so you should be.

Why? Because the world is on the brink of a huge transformation in how it moves money around. And at the heart of that change is the mobile phone.

Some of the analyst projections are eye-popping. Juniper recently put a $1.3 trillion value on the total market for all mobile transactions (including ticketing and P2P money transfer) by 2017.

However accurate that turns out to be, few can doubt that revolution is in the air.

Simply, money is being digitised, and the phone – the always-on, data-enabled, location-aware phone – is the logical place for it to be stored and transferred.

But mobile money is so bloody complicated. It means lots of things.

We think it can be boiled down to nine areas:

1. Operator billing

2. In-app micropayments

3. Text-based P2P transfers (M-Pesa et al)

4. NFC contactless payments

5. Cloud-based mobile wallets

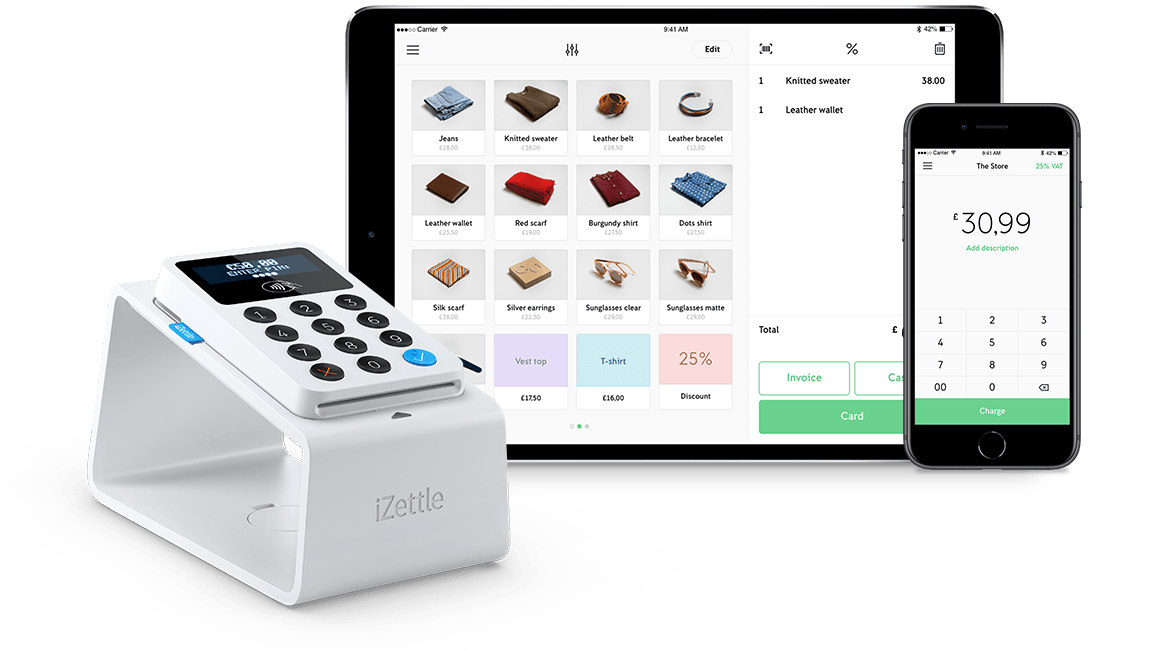

6. Mobile card-readers (Square etc)

7. Mobile banking

8. Mobile commerce and the high street (offer redemptions using QR codes and so on)

9. Social commerce (Facebook, gifting etc)

So, this site will aim to report on all these sectors. And we’ll do so in plain English.

If we fail in this, please write in and tell us off.

Actually, write in anyway.

And those of you interested in advertising or sponsorship, well, we’d especially love to hear from you.